Catalyzing the Transition

News

Forbes: New Gas Storage Facility Arrives Just In Time For The Texas Grid

By David Blackmon, Senior Contributor, a Texas-based public policy analyst/consultant. Updated Jan 16, 2025, 10:35am EST HOUSTON, TEXAS - DECEMBER 14: Pablo Vegas, president and CEO of ERCOT, left, Texas Governor Greg ... [+]Houston Chronicle via Getty Images As...

Significant Investment in Western LNG Funds Ksi Lisims LNG and PRGT Projects to FID

Transition Equity Partners Invests in Western LNG as Part of $150m Commitment to Bring Both Projects to FID in 2025 On December 30, 2024, Western LNG LLC (“Western”) completed a private placement of equity securities, securing over $150 million in commitments. This...

WSJ Exclusive: Transition Equity Partners Backs Solar-Module Maker Heliene

Hamilton Lane joined in the $54 million growth investment to help the company build a new U.S. factory Martin Pochtaruk, CEO of solar-module maker Heliene, at the company’s factory in Mountain Iron, Minn. Heliene plans to use a $54 million investment led by Transition...

Strategy

Our Focus: Low-Carbon, Reliable, and Cost Efficient

At Transition Equity Partners, LLC, our strategic focus is identifying investment opportunities that facilitate the ongoing shift to cleaner, smarter, more reliable energy infrastructure, and the supporting supply chains and services.

Reducing the carbon intensity of North America’s energy sector is a decades-long process that demands substantial investment, and a strategic focus on the most impactful solutions.

TEP is facilitating this shift through strategic partnerships and investments in leading developers, and projects delivering the solutions needed to reliably decarbonize North America’s economy.

Sectors

Capitalizing a Generational Transition

The global shift to low-carbon energy infrastructure and supply chains will require large amounts of strategic capital working alongside strong management teams to deliver the necessary projects. The TEP team aims to make both growth equity and control buyout investments in opportunities across three strategies within this transition:

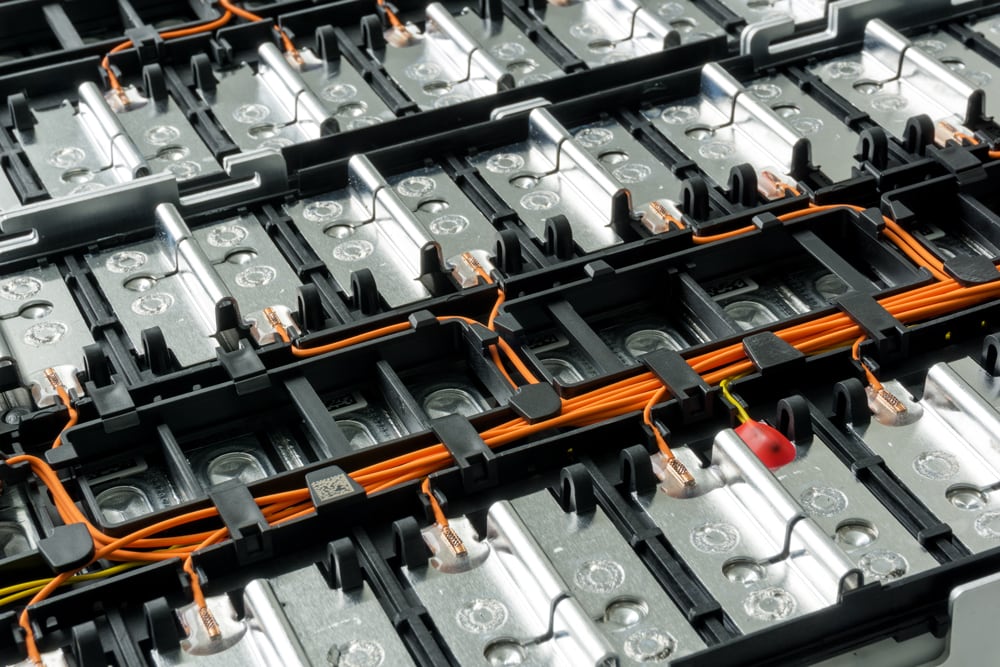

- Renewable Energy

- Decarbonization Infrastructure

- Clean Energy Supply Chain

Leadership

Leading the Change Since 2000

For more than twenty years, TEP founder Pat Eilers has helped pioneer investments in renewable, sustainable energy, building an expansive network of relationships across the United States in the process.

From building wind farms along the volcanic ridges of Oahu’s North Shore to investing in clean-burning natural gas power plants serving New York City, he’s personally directed energy infrastructure capital deployment for over 20 years. TEP’s Partners have invested more than $2bn across the energy transition.

Portfolio

Track Record of Transformative Investments

The investments the TEP team currently manages originated with longstanding relationships. Our investments and active support of industry leading management teams to deliver lower-carbon, reliable, cost effective energy infrastructure and supporting supply chains demonstrates our team’s ability to source and execute proprietary investments that capitalize on rapidly transitioning sectors.