A Strategically Balanced Approach to Energy Opportunities

The US Government has set a target of achieving net zero emissions by 2050, including zero carbon electricity production by 2035. Achieving these ambitious goals will require an all-of-the-above approach, including as much zero carbon electricity as possible, responsible load reduction and management, innovative infrastructure to decarbonize hard to abate industries and a robust, domestic supply to chain to fuel this growth. This will require the strategic management and upgrade of existing infrastructure, along with the development of many new projects, both requiring large amounts of capital responsibly allocated to the most impactful projects.

Our strategic investments break out into three target sectors: Renewable Energy Infrastructure, Efficiency & Sustainability, and Transitional Energy Infrastructure.

Renewable Energy

Partnering with companies actively creating portfolios of renewable energy infrastructure to generate and store zero-carbon electricity, underpinning the reduction of the grid’s carbon intensity.

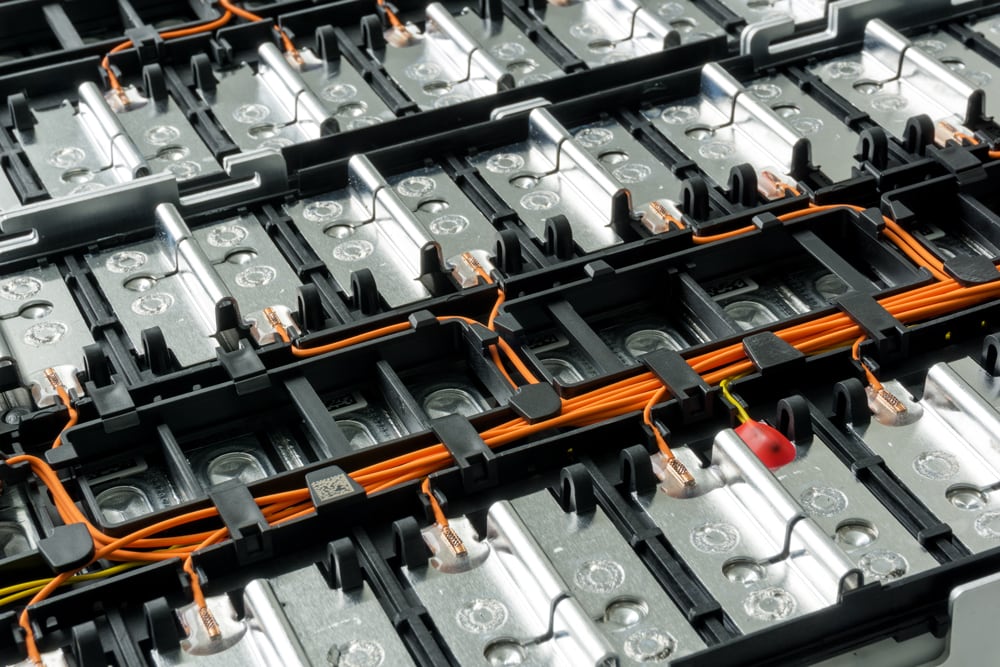

Includes development platforms creating wind, solar and battery storage portfolios across utility-scale or commercial & industrial applications.

Decarbonization Infrastructure

Partnering with companies implementing solutions & infrastructure that enhance energy & electrical reliability while facilitating the shift to a low-carbon economy.

Includes transactions across energy efficiency, low carbon molecules production transportation and storage, and carbon capture and sequestration or utilization.

Clean Energy Supply Chain

Partnering with companies whos’ products or services support energy infrastructure deployment, with a focus on domestication of value chains to strengthen energy security.

Includes transactions across energy transition equipment or subcomponent manufacturing, critical minerals production or refining and related service providers.